Starting a business is an exhilarating journey, but it often requires capital to transform a vision into reality.

Finding investors can feel like navigating a maze, but with the right strategies, you can significantly increase your chances of success.

This article breaks down various avenues for securing funding, drawing insights from online discussions and industry best practices.

Why look for investors?

Before seeking investors, it's essential to understand not just how to find them, but why you need them. Outside funding can be a powerful catalyst for growth, providing the resources necessary to:

- Scale Operations: Expand production, hire talent, and upgrade infrastructure to meet growing demand.

- Accelerate Growth: Invest in marketing and sales efforts to reach a wider audience and increase market share.

- Fuel Innovation: Fund research and development, enabling the creation of new products or services and staying ahead of the competition.

- Gain a Competitive Edge: Secure resources to outpace competitors and establish a strong market position.

Essentially, investors provide the financial fuel to propel your startup to the next level.

However, it's crucial to determine how much funding you truly need and what it will be used for. Create a detailed financial plan that outlines:

- Initial Costs: Equipment, technology, staffing, and operational expenses.

- Projected Revenue: Realistic forecasts based on market research.

- Growth Milestones: Specific goals that require funding, such as product development, marketing campaigns, or expanding to new markets.

12 best strategies to find investors

Once you have a solid understanding of your funding needs and the reasons behind seeking investment, you can start exploring the best avenues to find the right partners for your venture.

Here are 12 effective strategies, drawing from both time-tested methods and modern approaches:

- Craft a Solid Business Plan: A well-researched business plan is your startup's foundation. It should clearly outline your goals, target market, revenue model, and growth strategy. A comprehensive plan demonstrates your seriousness and instills confidence in potential investors.

- Determine Your Funding Needs: Before seeking investment, clearly define how much capital you require and how it will be used. This helps target the right investors and demonstrates financial acumen.

- Network Extensively: The power of networking cannot be overstated. Attend startup events, join entrepreneurship organizations, and connect with people in your industry. Many investors are found through referrals and personal connections.

- Pitch Competitions: Participating in pitch competitions can provide valuable exposure to potential investors and offer opportunities to refine your pitch.

- Pitch Effectively: When you get a chance to pitch to investors, be concise, compelling, and address key questions: the problem your startup solves, your market opportunity, your team's qualifications, and your financial projections.

- Demonstrate Market Potential: Investors want to see that your product or service has a viable market. Conduct thorough market research and present data that supports your claims.

- Government Programs and Small Business Loans: Explore government-backed programs and small business loans that can provide initial funding or supplement other investment sources.

- Friends and Family: While mixing business and personal relationships can be tricky, friends and family can be a source of initial funding for some startups.

- Bootstrapping: Initially funding your startup with personal funds or revenue demonstrates commitment and can make your venture more attractive to investors later on.

- Seek Mentorship: Experienced mentors can guide you through the fundraising process, offer valuable advice, and connect you with potential investors.

- Maintain a Strong Online Presence: A professional website and active social media profiles are essential. Investors often research companies online before committing.

- Patience and Perseverance: Finding the right investor takes time. Be prepared for rejections and view them as learning opportunities to improve your approach.

4 types of investors

Finding funding will be slightly different for each type of investor, so our strategies will be completely different depending on what exactly you're looking for.

We broke down the main types of investors and how to connect with them to secure an investment:

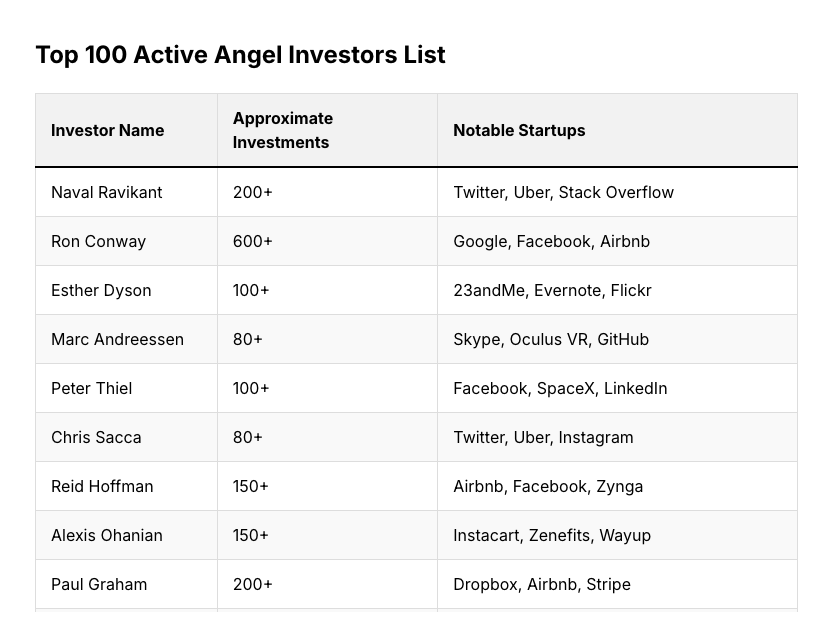

Angel Investors

Angel investors are individuals who invest their personal capital in startups, typically in the early stages.

They often provide not just funding but also mentorship and industry connections.

They typically invest in exchange for equity, meaning they'll own a portion of your company.

Our Find AI agent can help you find angel investors with AI:

Try a search like: "Angel investors interested in AI startups"

How to get them:

- Research Angel Networks: Look for organized angel investor groups in your region or industry. Websites like the Angel Capital Association (ACA) or directories provided by platforms like Gust can be helpful starting points.

- Leverage Online Platforms: Platforms like AngelList and Gust specialize in connecting startups with angel investors. Create a compelling profile for your company and actively engage with potential investors on these platforms.

- Network at Startup Events: Attend industry conferences, pitch competitions, and startup meetups. These events often attract angel investors looking for new opportunities.

- Seek Referrals: Tap into your existing network. Mentors, advisors, and other entrepreneurs might be able to introduce you to angel investors they know.

- Craft a Concise and Compelling Pitch: Be prepared to deliver a clear, concise, and persuasive pitch that highlights the potential of your business and the value proposition for the investor.

Venture Capital (VC)

Venture capital firms are professionally managed funds that invest in high-growth startups with the potential for significant returns.

They typically invest larger sums than angel investors but have stricter due diligence processes and higher expectations.

Getting to $500k in Annual Recurring Revenue (ARR) is often the key to securing seed investment from a VC, with Series A rounds typically available to companies doing $2-5M in revenue.

Our Find AI agent can help you find VCs with AI:

Try a search like: "VCs focusing on climate tech investments"

How to get them:

- Target the Right Firms: Research VC firms that specialize in your industry and stage of development. Many firms have specific investment theses, so finding a good fit is crucial.

- Build Traction and Achieve Milestones: VCs want to see evidence of traction and growth. Focus on hitting key milestones, such as reaching $500k ARR for seed funding or $2-5M ARR for Series A. If you reach those milestones, many VC firms will find you on their own.

- Network with Associates and Partners: Attend industry events and conferences where VC professionals are present. Building relationships with associates can often lead to introductions to partners.

- Warm Introductions: VCs are more likely to consider your startup if you're introduced by someone they trust. Leverage your network to get warm introductions to relevant firms.

- Prepare a Detailed Pitch Deck and Financial Model: VCs require a thorough understanding of your business. Prepare a comprehensive pitch deck and a robust financial model that demonstrates your growth potential.

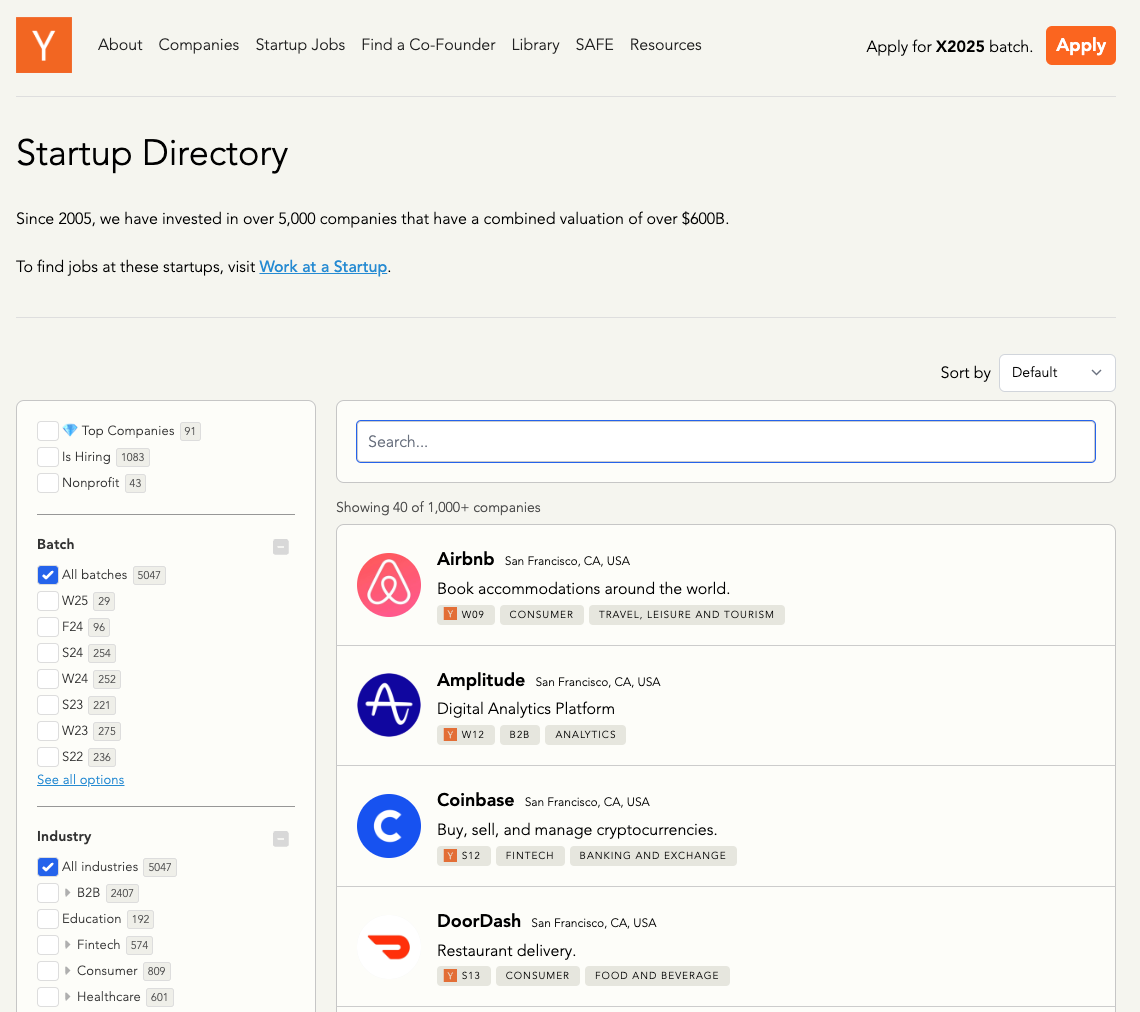

Accelerators and Incubators

Accelerators and incubators are programs designed to support early-stage startups.

They provide mentorship, resources, office space, networking opportunities, and sometimes seed funding in exchange for equity.

Y Combinator and Techstars are two of the most well-known examples.

How to get them:

- Research Programs: Identify accelerators and incubators that align with your industry, stage, and goals. Consider factors like program duration, mentorship quality, and alumni network.

- Apply Strategically: Accelerator applications are highly competitive. Tailor your application to each program's specific focus and highlight why your startup is a good fit.

- Network with Alumni: Connect with founders who have gone through the programs you're interested in. They can provide valuable insights and advice on the application process.

- Showcase Your Team's Strengths: Accelerators often place a strong emphasis on the founding team's capabilities and commitment.

- Prepare for Interviews: If you make it to the interview stage, be ready to articulate your vision, demonstrate your passion, and answer tough questions about your business.

Private Investors

Private investors can be individuals, family offices, or groups who invest in private companies.

They may be harder to identify than angel investors or VCs, as they often operate more discreetly.

How to get them:

- Industry Networking: Attend industry-specific events, conferences, and trade shows. Build relationships with people in your field who might be potential investors or know of them.

- Professional Networks: Leverage platforms like LinkedIn to identify and connect with high-net-worth individuals who might be interested in investing in your industry.

- Family Offices: Research family offices that invest in your sector. These are private wealth management firms that manage investments for affluent families.

- Seek Referrals: Tap into your network of advisors, mentors, and other entrepreneurs. They might be able to introduce you to private investors they know.

- Build Trust and Rapport: Private investors often invest based on relationships and trust. Focus on building genuine connections and demonstrating your long-term vision.

By understanding the characteristics and motivations of each investor type and employing these targeted strategies, you can significantly improve your chances of securing the funding you need to propel your startup to success.

Remember that persistence, preparation, and a compelling story are key to attracting any type of investor.

Best AI tools to find investors

While traditional methods of finding investors remain relevant, now we have new powerful tools that can significantly speed up the process.

These tools leverage AI and massive datasets to help you identify and connect with potential investors more efficiently.

AI-Powered Investor Search with Find AI

Find AI offers an innovative approach to investor discovery. It uses artificial intelligence to search through a database of over 1+ million professionals, including LinkedIn profiles, to find investors who match your specific criteria.

How it Works:

- Targeted Queries: You can input specific queries like:

- "Angel investors interested in AI startups"

- "VCs focused on climate tech"

- "Partners at top-tier VC firms"

- "Seed investors in B2B"

- "Seed investors in [your city]"

- "Investors interested in [your industry] in [your country]"

- AI-Driven Search: Find AI analyzes its database, including LinkedIn profiles and other data sources, to identify individuals who fit your criteria. It looks for signals like investment history, industry focus, and stated interests.

- Qualified Lead Generation: The platform provides you with a list of highly qualified leads, including their names, titles, companies, and relevant experience.

Personalized Outreach with Find AI and Other Tools

Find AI can also enrich the leads it generates with additional data points, such as location (city/country) and other relevant information, enabling highly personalized outreach. This is crucial because a personalized message is much more likely to resonate with a potential investor than a generic, mass-produced email.

For example, including an investor's city in your email shows that you have done your research and are not just sending a mass email, but truly care about their interests.

Other tools to enhance outreach include:

- Hunter.io: Helps you find email addresses associated with a particular domain or person.

- Apollo.io: A comprehensive sales intelligence platform that provides email addresses, contact information, and engagement tools.

Cold Outreach Strategies:

- LinkedIn: Connect with potential investors on LinkedIn, sending a personalized message along with your connection request. Engage with their content and build a rapport before sending a direct pitch.

- Email Campaigns: Use email marketing tools to send targeted email campaigns to your list of qualified leads. Craft compelling subject lines and personalize each email as much as possible. Using the email template below, make sure to customize each email to each investor.

- Cold Calling: While less common today, cold calling can still be effective if done strategically. Prepare a concise and engaging script, and be respectful of the investor's time.

Sample Email Template:

Here is an example that you can use as inspiration.

Subject: [Your Company Name] - Revolutionizing [Your Industry] in [Investor's City/Region]

Dear [Investor Name],

My name is [Your Name], founder of [Your Company Name], a [your industry] startup based in [your city]. We're developing [briefly describe your product/service] to address [problem it solves] in the [your industry] market.

I came across your impressive investment portfolio on [Source, e.g. Find AI, LinkedIn], and your specific interest in [mention specific area related to your startup, e.g., AI, climate tech, B2B] in [Investor's City/Region] particularly caught my attention.

Given your experience in [investor's area of expertise], I believe you'd appreciate our innovative approach to [mention key feature or benefit].

We've already achieved [mention key milestones, e.g., traction, user growth, pilot programs] and are seeking [investment amount] to [explain how the funds will be used].

Would you be open to a brief call to discuss how [Your Company Name] is poised to disrupt the [your industry] market in [Investor's City/Region]?

Thank you for your time and consideration.

Sincerely,

[Your Name]

[Your Title]

[Your Company Name]

[Your Website]Important Note: As you can see, this is a template, and it's crucial to personalize each email based on the specific investor and their interests. Research them thoroughly and tailor your message accordingly.

Definitely try out Find AI if you need to fill in the data for your leads. You can use an email as input and get all the data you might need. Afterwards you can use it in your email outreach campaigns with Hunter or other email tools.

Conclusion

In conclusion, securing funding for your startup requires a strategic blend of traditional networking, targeted outreach, and leveraging modern, AI-powered tools

By understanding your funding needs, identifying the right investor types, and crafting personalized pitches, you can navigate the complex landscape of startup financing and find the partners you need to turn your vision into a reality.

Remember that persistence and a tailored approach are paramount to success in this challenging but ultimately rewarding endeavor.

Kirill Ragozin • 04 Jun 2025

Welcome to AI-assisted sales development! This quick lesson covers the basics you need to get started. What Is AI-Assisted SDR? AI-assisted SDR means using artificial intelligence to: * Find better prospects faster * Research companies automatically * Write personalized emails at scale * Track what works and optimize Why It Matters Traditional SDRs spend 80% of their time on manual tasks: * Researching prospects one by one * Writing individual emails * Updating CRM records * F

Anson Hwang • 18 Feb 2025

Learn how to rename columns in Google Sheets with this simple guide. Enhance clarity, organization, and data analysis in your spreadsheets.

Anson Hwang • 04 Feb 2025

Generating leads for a B2B SaaS or enterprise software business can be challenging, especially if you rely only on traditional outbound tactics.

Anson Hwang • 22 Jan 2025

Seeking angel investors? Learn how to find the right investors for your startup and secure funding. Get expert tips & strategies now.